#100 EMA VS 200 EMA SERIES#

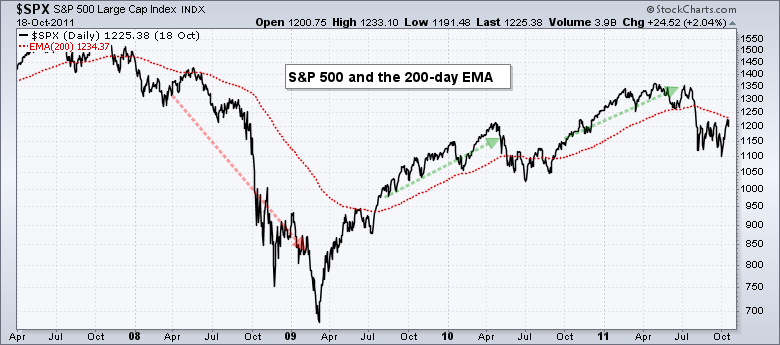

At the end of the new price period, that data is added to the calculation, and the oldest price data in the series is eliminated. Additional price data, such as the median price and opening price, can also be utilized. Generally speaking, an SMA is calculated using daily closing prices, but it is possible to use other time frames as well, even if they aren’t common. Notice how the 50-day line (in yellow) features more dramatic movements than both the 100-day (in brown) and the 200-day (in purple) lines: Here’s a look at the 50-, 100-, and 200-day SMAs on a CHF/JPY chart. In general, longer-term SMAs are more slowly affected by dramatic price swings, whereas shorter-term SMAs will be faster to respond. The purpose of the SMA is to overlay a chart with long-term price trends to see how current prices compare to a long-term average. On a 20-day SMA, for example, the moving average is the average asset price in that particular date range.

An SMA is the average of the closing prices for the time period highlighted. This is the reasoning behind the name “simple” moving average. Long before the rise of internet-based trading, the simple moving average was already well established due to its ease of calculation. But there are differences between the two. Moving averages are one of the most popular tools that forex traders lean on when attempting to understand market movements because they add an extra layer to any chart analysis you’re conducting, highlighting exactly where the price action is happening.īased on pure popularity, the exponential moving average (EMA) and the simple moving average (SMA) are the two most common moving average tools.

0 kommentar(er)

0 kommentar(er)